Hello, how’s everyone doing? In the state of New York, car insurance is not just an option—it’s a legal requirement that every driver must comply with. In a world full of uncertainties on the road, car insurance serves as a shield, offering peace of mind and protection. In this article, we will explore the insurance requirements for every driver in New York, as well as the benefits that come with this essential protection. Let’s dive in, and don’t hesitate to keep reading!

Types of Protection Needed for Your Car

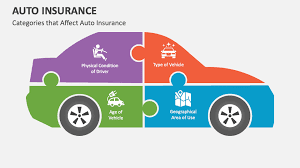

A car is one of your most valuable assets, and it deserves maximum protection to stay safe and well-maintained. One of the most critical forms of protection is auto insurance, which provides financial coverage in the event of accidents or damage.

Additionally, installing an alarm system or advanced security features can help prevent theft. Paint protection is also necessary to keep your vehicle’s appearance pristine, guarding against scratches and weather-related damage. Tinted windows can shield the interior from harmful UV rays.

Routine maintenance, such as engine check-ups and oil changes, is part of long-term protection. Make sure to park your car in well-lit and secure areas and use steering or tire locks when needed.

Don’t forget the importance of obeying speed limits, which significantly reduces the risk of accidents. By safeguarding your car from various threats, you can ensure that it remains in excellent condition and safe to drive.

Comprehensive protection provides peace of mind on the road, allowing you to enjoy your trips with confidence. Every car owner should recognize that investing in protection is a wise step toward the long-term value and safety of their vehicle.

Minimum Car Insurance Costs in New York

In New York, the minimum cost of car insurance is a crucial factor for every driver to consider. Since 2021, the local government has required all vehicle owners to carry insurance that meets certain minimum limits.

These costs vary depending on factors such as the type of vehicle, driving history, and location. On average, car owners in New York can expect to pay around $1,500 per year to meet the minimum insurance requirements.

While this cost may seem significant, car insurance is a vital form of financial protection. It helps mitigate financial losses caused by accidents or damage, offering a sense of security when driving on busy roads.

Car Insurance Registration Process in New York

Registering for car insurance in New York involves filling out forms, selecting the appropriate policy, and paying the premium. This ensures comprehensive protection and safer driving.

Penalties for Not Having Car Insurance

On busy roads, a car may symbolize freedom—but without insurance, that freedom can backfire. Penalties for not having car insurance can be severe, including hefty fines and the potential loss of your vehicle.

Moreover, legal uncertainties may arise, threatening the driver’s peace of mind. In the event of an accident, being uninsured could mean bearing full responsibility, adding unnecessary psychological stress.

Therefore, car insurance is not just about protecting your assets—it’s about ensuring safety and legal stability on the road.

How to Choose the Best Car Insurance Provider

Choosing the best car insurance provider is like finding a true friend: you want someone you can trust, who offers complete protection, and provides excellent customer service.

Final Words

When driving in New York State, understanding car insurance requirements is essential for protecting yourself and others on the road. By complying with the laws, you not only avoid legal consequences but also ensure peace of mind while driving.

We hope this article has provided valuable insights. Stay tuned for more informative articles, and don’t forget to share this one with your friends. Thank you for reading!

Let me know if you’d like this version optimized even further for SEO or adapted into a formal blog post layout with headings, meta description, and internal links.